cash app venmo zelle tax

Cash App Taxes formerly Credit Karma Tax is a fast easy 100 free way to file your federal and state taxes. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the.

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

The Internal Revenue Service is cracking down on people who underreport earnings received through digital payment apps such as PayPal Venmo Cash App Zelle and others.

/images/2022/02/08/cash-app-and-venmo.jpg)

. Now if youre a business. Apps Software Cybersecurity Mobile Smart Home Social Media Tech Industry Transportation All Tech. Millions of people have trusted our service to file their taxes for free and.

Payments of 600 or more through third-party payment networks like Venmo Cash App or Zelle will now be reported to the IRS. Starting January 2022 if you receive more than 600 from either CashApp Zelle or Venmo the IRS will be requiring you to pay taxes on that. If you make more than 600 through digital payment apps in 2022 it will be.

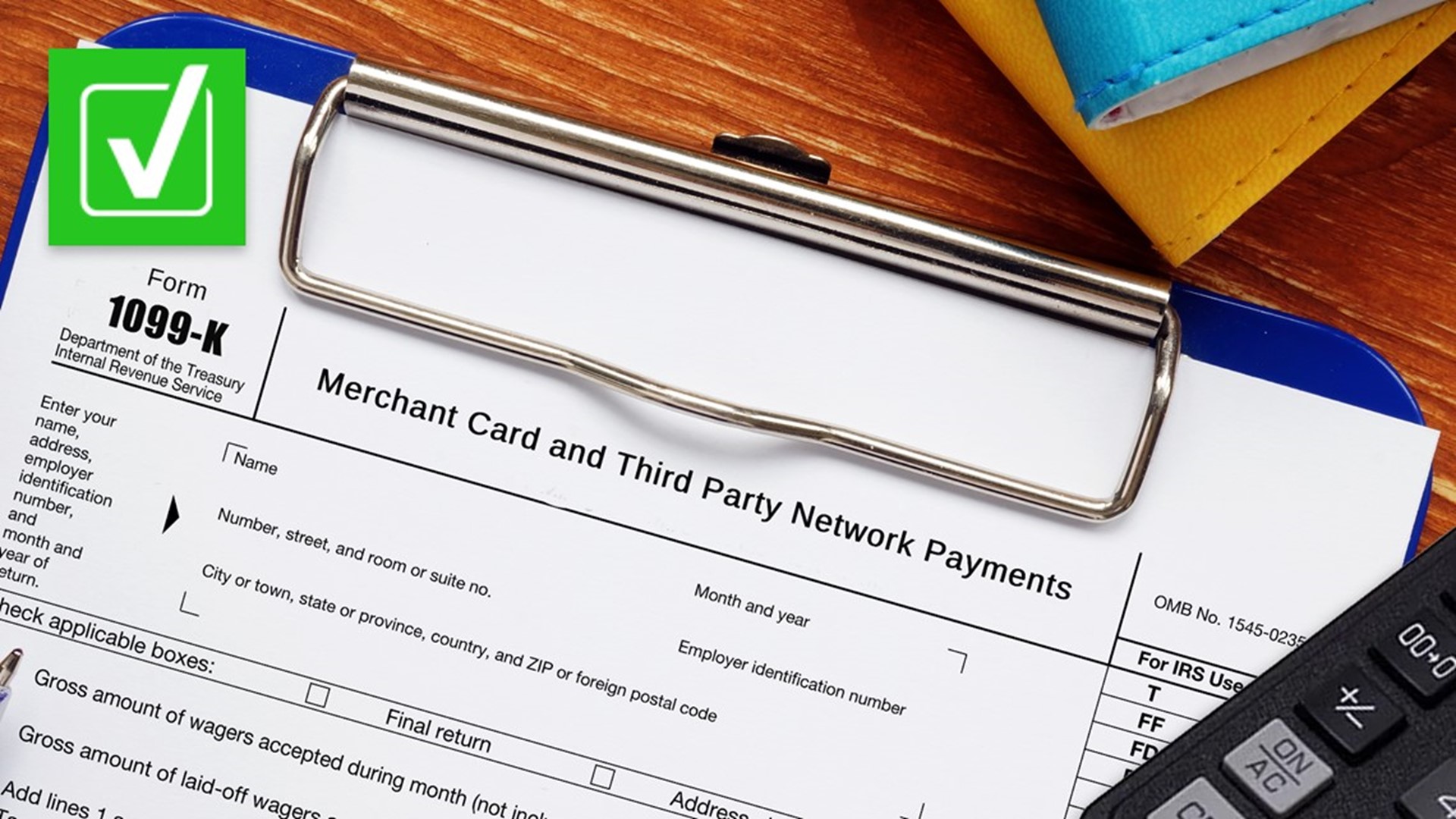

And for many people in 2023 life will bring a 1099-K form to ensure certain transactions on apps like PayPal Venmo and Cash App are taxed appropriately. PayPal Venmo and Cash App have made it possible for users to process transactions as friends and family to avoid being taxed. At this time Zelle says that.

Youll Owe Taxes on Money Earned Through PayPal Cash App and Venmo This Year. Fact or Fiction. A recent piece of TikTok finance advice has struck terror into the hearts of payment app users claiming that anyone who receives more than 600 on platforms like Venmo Zelle.

Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo. 10000 253 - 3 Ways to Avoid Paying Taxes via Payment Apps CashApp Venmo Paypal Zelle. The IRS is cracking down on the apps to make.

1 mobile payment apps like Venmo PayPal Zelle and Cash App are required to report commercial transactions totaling more than 600 a year to the IRS. For the 2022 tax year you should consider the amounts shown on your 1099-K when calculating gross receipts for your income tax return PayPal warns. With Venmo receiving funds takes one to three business daysunless you pay a 175 instant transfer fee.

One of the main differences is Zelle transfers are instant and free. As of Jan. The IRS will be able to.

Why It Matters 101 - Types of Taxable Transactions 116 - The New Tax Rule - 600 v. So if you use CashApp Venmo Zelle or Paypal like most do to send money for rent bills movies or other everyday actions for personal use fear not. As of January 1 2022 the use of third-party payment networks such as Venmo Cash App or Zelle for transactions amounting to more than 600 per year in exchange for goods or.

This new rule applies to paying cash app taxes including on income received through PayPal Venmo Cash App and most third-party payment networks. This is due to. The IRS requires the payment app to send you a 1099-K by January 31 if you received more than 600 in commercial transactions during the preceding tax year.

However Zelle does not offer the option because. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions.

Starting This Year Know Your Buyer Laws Start Coming Into Effect For The Us Digital Payment Services Like Paypal Venmo Zelle Cash App Or Any Third Party Settlement Provider Will Report To Irs

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

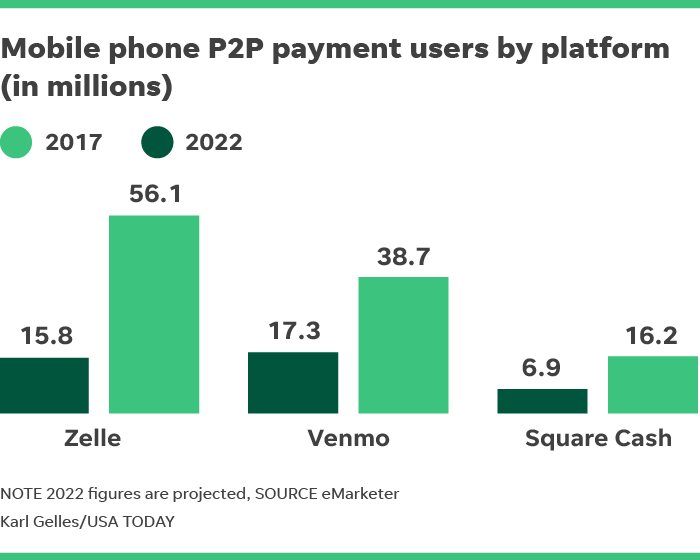

Venmo Zelle And Cash App Are Tops In Mobile Peer To Peer Payments A Foolish Take Wfaa Com

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Irs Tax On Cashapp Zelle Venmo On Amounts More Than 600 Starting Jan 2022 Irs Immigration Immigrationlawyer Greencard Usa Florida Business Taxes By Florida Immigration Law Counsel Facebook

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

New Law Impacting Peer To Peer Payment App Users

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Everything To Know About Venmo Cash App And Zelle Money

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Irs Tax On Cashapp Zelle Venmo On Amounts More Than 600 Starting Jan 2022 Flilc Shorts Youtube

Venmo And Zelle Tax Confusion Youtube

Cash App Vs Venmo How They Compare Gobankingrates

Your Account Cash Transfer Apps Public Service Credit Union

If You Use Cash App Venmo Zelle Or Paypal You Should Watch This Video I Received Money From Cash App Venmo And Paypal Should I Declare Them For Tax Purposes

New Rule To Require Irs Tax On Cash App Business Transactions Kbak